A Reliable Provider of BIR CAS in the Philippines

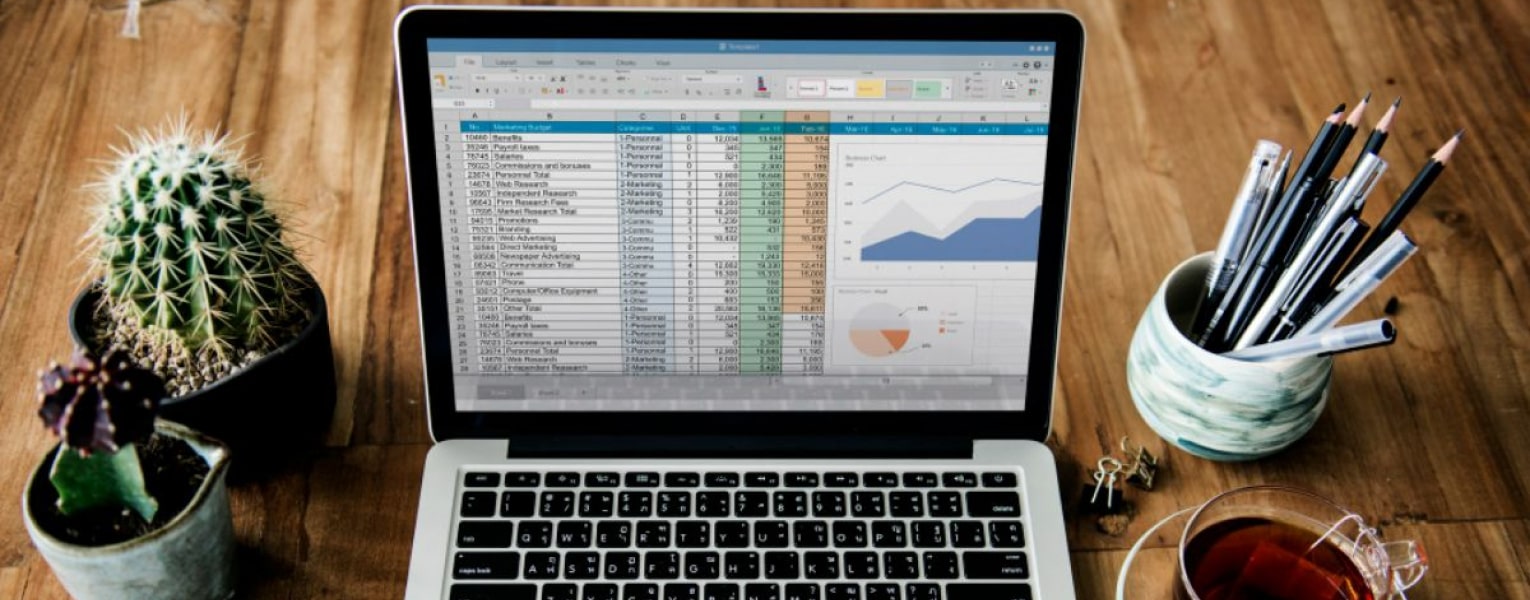

Computerized accounting systems in the Philippines are not only necessary but have already become crucial for many business operations. Different business types have already seen an increase in operational efficiency thanks to these digital solutions.

In addition to guiding through the entire BIR CAS implementation process, DynamIQ facilitates necessary changes to systems and teams. To enhance capabilities, they provide staff training and step-by-step guidance.